Should Start Ups Bother With a Board of Directors?

The short answer is, definitely. Why? Mostly to protect the founders from themselves.

A Board of Directors’ Priority Is the Business, Not the Shareholders

A Board of Directors’ Priority Is the Business, Not the Shareholders

Company First

We all know that the priority of a Board of Directors is the well-being and success of the business, not the shareholders. The idea behind this “business first” concept is that if the business is taken care of, benefits to shareholders should follow. A healthy, successful business leads to happy shareholders.

So, if the Board of Directors does not work for the benefit of the shareholders (i.e., founders) but the business, why should the founders bother with one if they own the majority of the business and control the company’s direction?

Institutionalization

Institutionalizing a good structure and governance model from the get-go helps a company scale without the typical growing pains. If the founders set out to define a Board of Directors that can then nominate, select, and fire a CEO, hold him or her accountable against well laid out plans, and request that major structural or financial changes be reviewed and approved by them, it inevitably leads to the professionalization of any business and the building of a foundation from which to grow.

5 Steps to Set Up a Board

Here is a quick 5-item list of how to start your own Board of Directors:

1. Build the Team

Define what functional, industry, or influence areas you would like to have access to and recruit board members accordingly. A financial expert, a well-known industry leader, an influential personality, a management or leadership development consultant, and major shareholders are the typical candidates.

Select Board Members Based on Specific Business Needs

Select Board Members Based on Specific Business Needs

Compensating board members is an important component for any board. The idea is that compensation drives engagement and commitment. And, as with any other compensation plan, directors’ compensation must help align directors and founders priorities.

2. Empower the Board

Empowering the board to fire and hire the CEO and any other senior executive role that can make or break the company is key. In addition, it is crucial to let them work on the implementation of effective and unbiased controls, let them be part of major financial or structural decisions including executive compensation, and get them involved with governance, audits, and planning. If you have your Board’s strengths working for you, you might as well use them. For these major decisions, many heads usually think better than one.

3. Develop a Routine

Get a rhythm going. Put together an annual calendar of regular meetings to discuss all relevant topics, including an annual meetingn to review annual strategic, operating, and financial plans, select board members, and review audit reports, if any. This does prevent the scheduling of special meetings to deal with board-level issues that may arise from time to time such as equity transactions, HR issues, financial commitments, etc.

4. Drive Accountability

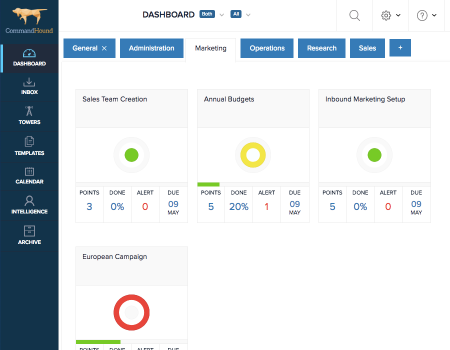

Take minutes, follow up, report, and escalate until the action items decided at board meetings are executed as planned. Using an accountability tool like CommandHound will help ensure that nothing falls through the cracks.

CommandHound’s Dashboard Keeps Track of How Board Action Items Are Progressing

CommandHound accomplishes this by recording action items, assigning responsibilities, defining escalation ladders and schedules, sending reminders, and reporting on the status of things. More importantly, CommandHound keeps track of action item completion performance by individual to better track how is doing what when.

5. Adjust as Needed

As the needs of the business change, add and/or replace board members, change compensation, and increase or decrease involvement levels as needed. Push for as much involvement as makes sense but keep in mind the diminishing-returns curve.

Next Steps

Would you like to know how CommandHound can help you increase the effectiveness of your Board of Directors through accountability?